Real estate at the beginning of the year: Many positive changes

The first 4 months of the year recorded many positive signs when the number of apartments launched on the market and liquidity increased.

Cash flow returned, liquidity improved

Many market research units assess that, compared to the beginning of 2023, the real estate market in early 2024 has more positive signs in terms of interest level and number of postings.

According to Batdongsan.com.vn’s real estate consumer psychology index (CSS) report, the psychology of real estate buyers and sellers is no longer as cautious as in 2023.

The real estate market sentiment index in the first half of 2024 increased by 3 points compared to the second half of 2023, thanks to the improvement in consumer satisfaction with the potential increase in real estate prices and home loan interest rates. and policies and market situation.

According to a report by Batdongsan.com.vn, the level of consumer interest in searching for real estate has grown again in the first quarter of 2024, 62% of survey participants are willing to take advantage of the opportunity to Buy real estate at a discount or with good policies.

The warming market is most evident when new supply entering the market has grown significantly and the transaction rate has also stabilized.

When the real estate market at the beginning of the year gradually warmed up, brokers, trading floors and investors launched business campaigns early so as not to miss the opportunity to reach a large number of potential customers.

Typically, the Hanoi market just witnessed 5,000 people lining up to book a new project for sale.

In the southern region, after Tet, a series of products from investors were launched on the market with significantly improved liquidity.

According to the real estate market report in Ho Chi Minh City and neighboring provinces conducted by DKRA Group, in the first quarter of 2024, the apartment segment market has a primary supply of about 12,967 units and a consumption of nearly 2,000 units. .

With the type of townhouses and villas, in the first quarter of 2024, the primary supply of Ho Chi Minh City and neighboring provinces was about 4,345 units, the consumption of this supply increased by 43%.

Along with that, real estate prices also continue to increase, the strongest being in the apartment segment. According to Batdongsan.com.vn, the price of apartments for sale in Hanoi is close to the level of Ho Chi Minh City, reaching an average of 46 million VND/m2 in early 2024, approaching the mark of 48 million VND/m2 in Ho Chi Minh City. .

Mr. Lucas Ignatius Loh Jen Yuh – general director of Nam Long Group – commented that the real estate sector in Vietnam is moving to a more “mature” stage, meaning it does not develop massively but has the required “maturity”. Very high precision in product research and development from investors to meet the true needs of the market, helping to balance supply and demand. This is the same as in Singapore, the US, China and other developed countries before.

In the future, increased land fund and housing supply will mark a new period of competition among real estate developers.

Businesses will look to attract homebuyers by diversifying their products, where aspects such as service, purchasing experience and brand become important.

“For the company, instead of competing purely on price, the business aims to create differences in products and services, bringing unique lifestyles to customers of every segment that we develop. “.

There is still a lot of motivation in the long term

Positive signs at the beginning of the year are opening a new growth cycle for the real estate market. Experts say that this result is due to the total leverage coming from many factors such as reduced interest rates, open legislation and unprecedented stimulus policies of large real estate investors.

Recently, the banking system continuously lowered deposit interest rates to around 5%/year, home loan interest rates also decreased by only 5-10.5%/year. This helps people easily access financial leverage.

Besides attractive loan interest rates, the legal framework for the real estate market is also gradually becoming more open. Resolved legal obstacles help promote credit lending to real estate businesses and home buyers, open up capital flows as well as create a legal corridor for the market to develop.

In the bright spot of the market in the first months of the year, products that meet real housing needs with good quality of construction and utilities, meet the needs of end users, and reasonable prices.

At the shareholders’ meeting held a few days ago, Mr. Nguyen Xuan Quang – Chairman of the Board of Directors of Nam Long – commented that the market opportunities for real estate businesses are currently quite good. The reduced interest rate for home loans is lower than the pre-COVID-19 interest rate, and can compete with interest rates in other countries in the region.

He also said that pre-sales in the first quarter reached about 1,160 billion VND, 5 times higher than the same period last year, proving that homebuyers’ confidence has returned.

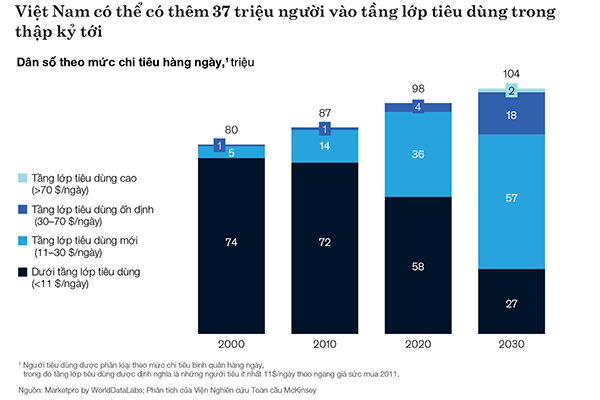

Another important reason is that the market is still attractive internally. Mr. Lucas Ignatius Loh Jen Yuh assessed that Vietnam’s economy is quite potential and the real estate sector here is in the early stages of growth.

A positive indicator is the speed of urbanization in big cities. This rate is about 38-40%, similar to the level recorded in China in the 2000s.

The company’s product market focus in the period 2024-2026 is a line of affordable housing products and commercial real estate products serving the existing integrated urban ecosystem.

Based on this foundation, we will begin researching other residential real estate product lines suitable for the “mature” market in the future. The company will also look for opportunities in other forms of real estate besides housing.

At the recent general meeting of shareholders, this company also announced a quite positive business plan with a sales target of more than 9,500 billion VND, net revenue of 6,657 billion VND, profit after tax of 821 billion VND, profit after tax of 821 billion VND. Profit after tax of parent company shareholders is 506 billion VND.