Gold bars decreased by more than one million dong

The price of SJC gold bars this morning decreased by more than 1 million VND per tael, falling below the threshold of 90 million VND when the world market plummeted.

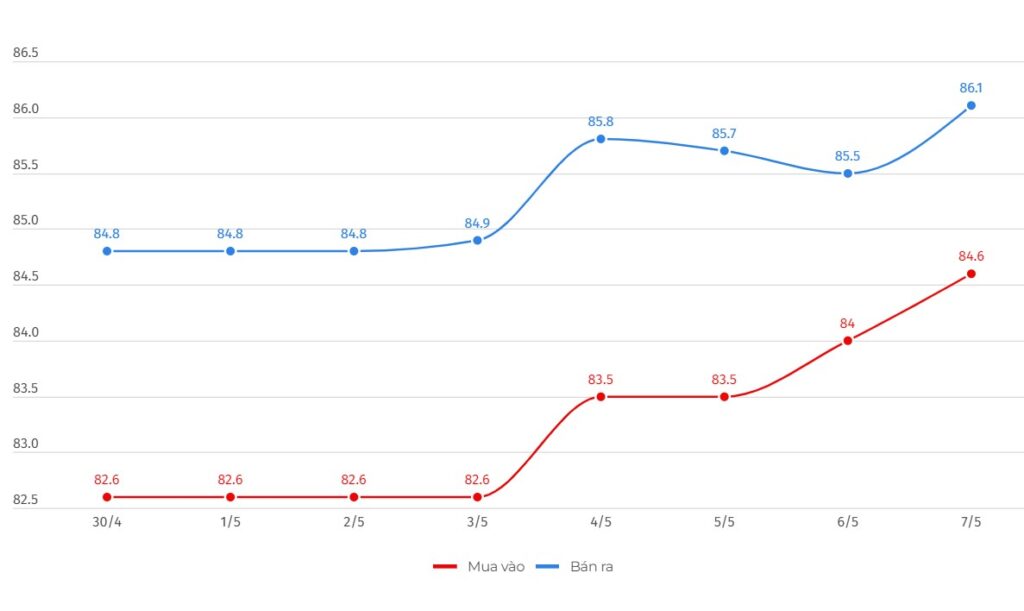

Late this morning, Saigon Jewelry Company (SJC) listed the price of gold bars at 87.8-89.8 million VND per tael, down 1.1 million VND compared to the end of yesterday. The buying – selling price margin narrowed to 2 million VND.

At other gold houses, precious metals also adjusted downward accordingly. DOJI Jewelry Group, Phu Quy, Bao Tin Minh Chau sell each gold bar around the threshold of 89.5-89.6 million VND, while Mi Hong trades at the SJC price.

Plain ring prices also went down. Each 24K ring at SJC this morning decreased by 600,000 VND in both buying and selling directions, currently trading at 75.2-76.8 million VND.

On the world market, the spot gold price closing on May 22 decreased by nearly 43 USD, to 2,378 USD per ounce. In this morning’s session, the price continued to go down, currently at 2,372 USD.

Prices fell after the US Federal Reserve (Fed) released the minutes of its April meeting, showing that officials are in no hurry to reduce interest rates. Some even mention the possibility of increased profits. High interest rates will increase the opportunity cost of holding precious metals.

Price of gold bars and plain rings at SJC from the beginning of the year until now

Within the past month, the State Bank has called for bids 8 times and had 5 successful sessions. In total, the management agency released 35,000 taels of SJC gold bars to the market.

After the first “sluggish” bidding sessions, the State Bank relaxed the conditions on the minimum and maximum bidding scale. According to the operator, this adjustment has helped in recent sessions to increase the number of participating members and the scale of gold supplied to the market.

In theory, bidding is a solution to increase supply to neutralize market demand, thereby helping to cool gold bar prices closer to the world level. However, experts all see this as just a temporary solution, but in the long term, the monopoly of gold bars needs to be eliminated.

In the newly published report, experts from the Institute of Economic and Policy Research (VEPR) and Think Future Consultancy also said that administrative measures, such as market inspections, requiring the use of electronic invoices, or investigating price manipulation will bring immediate effects to stabilize the gold market, instead of sacrificing foreign currency to massively import gold to stabilize prices.

The State Bank has announced an inspection of gold trading by credit institutions and businesses in the last 4 years. Inspection content includes compliance with gold trading laws; anti-money laundering; accounting regime, preparation and use of invoices and documents, and fulfillment of tax obligations. Inspection period is 45 days, with a scope from the beginning of 2020 to May 15, 2024.